Call it a clean bill of health.

Health-care stocks are poised to win out in the next leg of the ever-raging battle between growth and value that has played out for decades in the stock market, says Christian Fromhertz, founder and CEO of Tribeca Trade Group.

Value plays, tracked in part by the iShares S&P 500 Value ETF (IVE), have made a sustained comeback in recent months, with the IVE touching a 52-week high on Tuesday and beating the S&P 500’s performance for 2019.

But growth hasn’t totally fallen out of favor. The iShares S&P 500 Growth ETF (IVW) also hit a 52-week high on Tuesday, along with the broad market, suggesting investors aren’t fleeing the group.

“Market breadth is extremely strong across all equities,” Fromhertz, who has over 15 years of industry experience, said Tuesday on CNBC’s “Trading Nation.” “And what we’re seeing … in health care is, really, the group is starting to fire on all cylinders.”

In particular, Fromhertz focused on the Health Care Select Sector SPDR Fund (XLV), which holds shares of 61 of the S&P’s largest companies across the health insurance, biotechnology, pharmaceutical, equipment, medical device and life science subsectors.

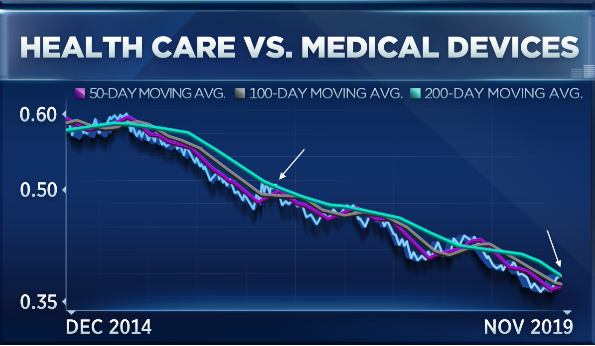

What made him even more bullish was the XLV’s performance relative to the high-growth iShares U.S. Medical Devices ETF (IHI). The recent upturn in the ratio means the broader health-care group is catching up to one of its best-performing subsectors, a positive move that likely improves health-care’s near-term prospects, he said.

“The whole group is starting to shift up,” Fromhertz said. “What I like about the ETF … [is] it captures both value and growth in there. So, really, as we’re seeing a see-saw back and forth between the two, I think this is a great way to play it.”

From the more stable, slower growers like Merck and Eli Lilly to the more growth-prone plays like Thermo Fisher Scientific and AbbVie, the XLV can give investors exposure to a quality blend of value and growth stocks, and it can do so on the cheap, Fromhertz said.

“The options market is a great way to play it,” he said. “You can go out to the January … at-the-money calls, which are right around $ 96 right now” in the XLV.

Why options? First, the XLV’s implied volatility, which affects option prices based on how much a given stock is expected to swing over time, “is super cheap” vis-a-vis its more selective counterparts, Fromhertz said. The SPDR S&P Biotech ETF (XBI), for one, is twice as expensive on an implied-volatility basis.

And when it comes to what many see as the biggest risk to the health-care trade — the 2020 presidential elections — Fromhertz said his suggested options bet provides a good hedge.

“That’s the biggest risk when you talk about health care and biotech, because they tend to move together,” he said. “I think the option trade is the right way to play [it]. This way, you’re limited to the downside by the premium that you’re investing in the trade.”

The XLV, IHI and XBI all closed less than 1% higher on Tuesday.

Disclosure: Fromhertz owns shares of XLV and IHI.